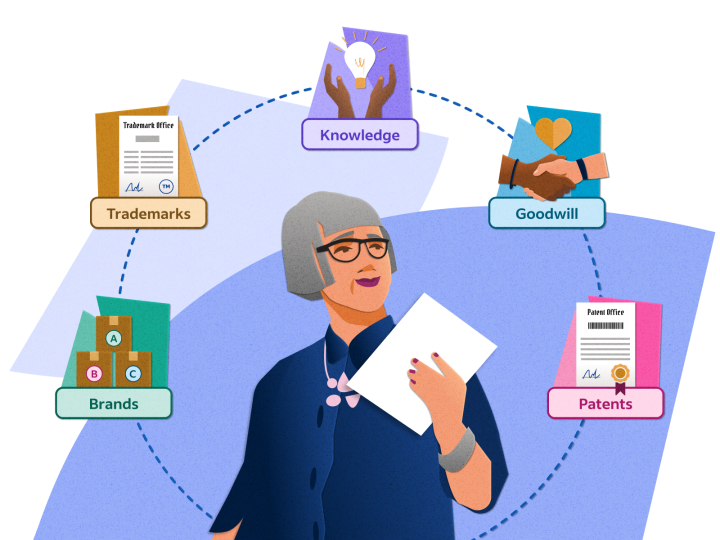

Intangible assets are assets that are not physically tangible, including brand recognition, intellectual property, and goodwill such as trademarks, patents, and copyrights. Intangible assets differ from tangible assets such as land, vehicles, and equipment. Financial assets like stocks and bonds are also considered tangible assets, as they derive value through contractual claims.

Understanding an Intangible Asset

Intangible assets can be categorized as indefinite or definitive. Indefinite assets remain with the company as long as they continue to operate. For example, a company's brand is an indefinite asset. A legal agreement that allows another company to operate under a patent would be an example of a definite asset. There are no plans to extend the agreement. Therefore, this agreement is classified as a definite asset with a short life span.

Although an intangible asset isn't as tangible as a factory or piece of equipment, it can be valuable to a company and could prove crucial to its success or failure. A business like Coca-Cola would not be as successful without brand recognition. While brand recognition isn't something that can be touched or seen, it can significantly impact sales.

Valuing Intangible Assets

Businesses can acquire or create intangible assets. A business might create a mailing list or a patent. A business can deduct expenses related to the creation of an intangible asset. All expenses incurred in creating an intangible asset can also be expensed. Intangible assets created by companies do not appear on the balance sheets and have no recorded value. This is why, when a company buys another, the purchase price often exceeds the book value of the assets on its balance sheet. The balance sheet of the purchasing company includes the premium as an intangible asset.

Example

Intangible assets will only be listed on the balance sheet if acquired. Company ABC could purchase a patent from Company XYZ at an agreed-upon $1 billion. This would result in Company ABC recording a transaction of $1 billion in intangible assets, which would be listed under long-term assets.

After amortization, the $1-billion asset could be written off over several years. Goodwill and other intangible assets with an indefinite life are not amortized. These assets are instead assessed annually for impairment. This is when the asset's carrying value exceeds its fair value.

Types of Intangible Assets

Identifiable Intangible Assets

Identifiable assets are assets that can either be bought or sold separately from the company but don't have a physical form. Examples of identifiable intangible assets include patents, trademarks, and copyrights. Identifiable intangible assets can often be indefinite. This means they will stay with the company as long as it exists. This category includes algorithms and proprietary data. An example is a social media platform's algorithm that governs its feed. It is an indefinite, intangible asset. This is because it can exist for as long as the company exists and will continue to add value over time. If the company chooses, it could be separable from the company and transferred to another company.

Unidentifiable Intangible Assets

Unidentifiable assets are intangible assets that cannot be purchased or sold. They only exist about the company. These intangible assets are reputation, client relationships, and goodwill. These assets are not easily quantifiable and cannot be sold. However, they can greatly increase a company's value. Intangible assets that are not easily identifiable are often considered definite assets. This means they have a short life span. For example, a client relationship is an asset only as long as it is maintained.

How to Add Intangible Assets to a Balance Sheet

Anything created internally cannot be assigned a fair value and can't be included on the balance sheet. Intangible assets purchased by your company can be amortized according to the above method and then placed on the balance sheet as tangible assets. Meta, formerly Facebook, couldn't include the Like button on its balance sheet as it is an intangible asset it created in-house.

Amortization of Assets

This is where things get more complicated. You will use amortization to calculate the value of many intangible assets over their lifetime. Amortization is gradually writing off the asset's initial cost over a period. Depreciation is a term that describes how an asset loses value over time. An example of this is a brand new car. It depreciates the moment it leaves the lot. Conceptually, amortization is similar to depreciation. However, it is applied to intangible assets rather than tangible assets.

All intangible assets cannot be amortized. Only those with a finite use life can. This refers to how long you have an intangible asset. Let's say your company gets a patent. The patent in the US has a 20-year expiration date. However, if the patent makes your company the best in the industry at what you do, then that patent has a finite useful lifetime of 20 years. After that, it expires.